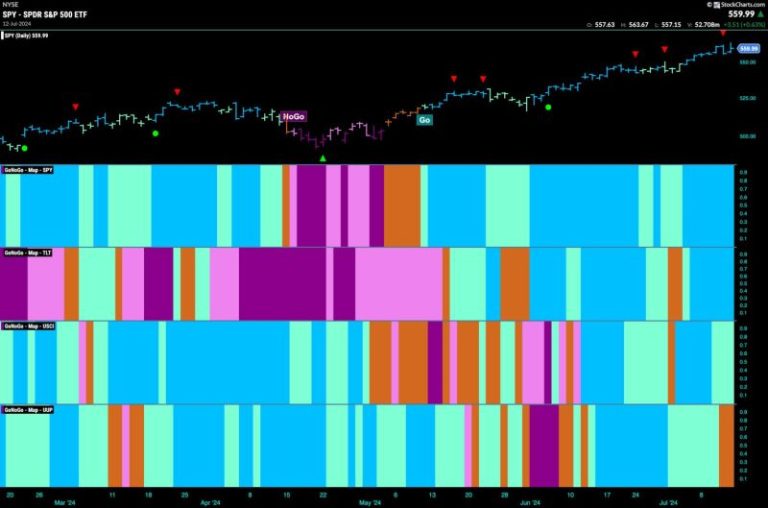

Good morning and welcome to this week’s Flight Path. It was another strong week for U.S. equities as we saw S&P hit new highs on a week of strong blue “Go” bars. Treasury bond prices had a good weeks as well with a string of blue “Go” bars and the U.S.…

The Nasdaq 100 is a major driver in the stock market and Nasdaq 100 breadth indicators should be part…

It was a very interesting week indeed. All-time high records continued to fall on a daily basis, but the…

In this edition of StockCharts TV‘s The Final Bar, Dave recaps a strong Monday for value stocks, with the Financial and…

Carvana (CVNA) stock has recently appeared in the StockChartsTechnical Rank (SCTR) Top 10 list, which makes it a stock…

Earnings are coming into focus and today Erin looks at the big earnings stocks to find out which look…

It was a very interesting week indeed. All-time high records continued to fall on a daily basis, but the…

This is a complimentary excerpt from the subscriber-only DecisionPoint Alert. NVIDIA (NVDA) broke down today in what looks like…

Here are some observations from golf that you might want to take into consideration. 1. I cannot begin to…